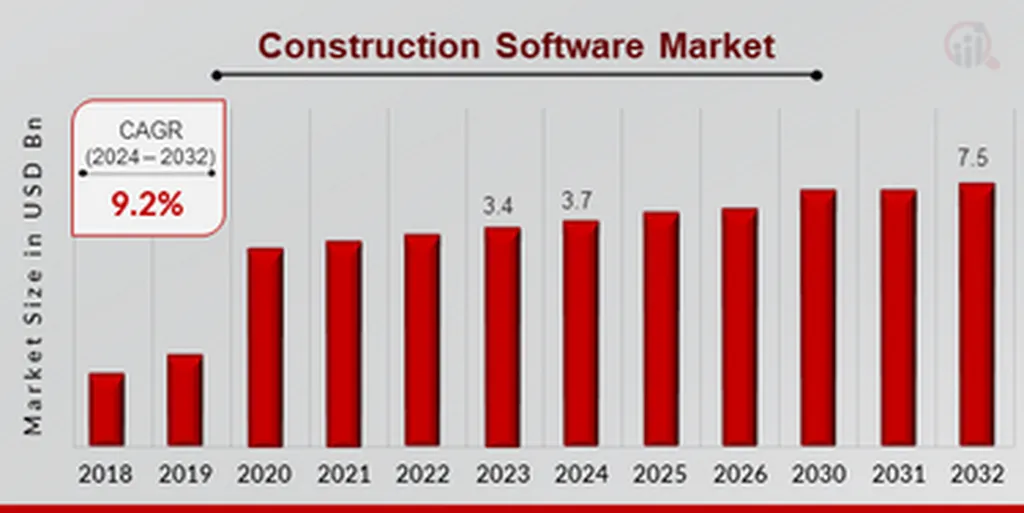

The construction software market is on the cusp of a transformative era, with projections indicating a surge from USD 3.4 billion in 2023 to USD 7.5 billion by 2032, growing at a CAGR of 9.2% during the forecast period (2025-2032). This growth is driven by an urgent need for cohesive digital solutions that enhance project collaboration and efficiency. The rise of integrated model-based planning tools is a central factor, allowing stakeholders to visualize workflows early and identify conflicts before execution. These tools foster alignment across teams and support predictive planning, emphasizing secure data sharing throughout project lifecycles.

The shift towards cloud-hosted platforms is a key trend driving this market. These platforms offer real-time access to project data and improved scalability, accommodating diverse firm sizes and project types. The integration of intelligent automation supports predictive insights and reduces manual tasks across planning, scheduling, and reporting. Mobile interfaces have enabled field teams to report progress and access updates immediately, enhancing connectivity with sensor networks for equipment monitoring, site safety, and maintenance planning.

Emphasis on modular architectures and open interfaces leads to interoperability within different enterprise systems. Sustainability-focused functions help track material use and measure environmental impact, reflecting a growing focus on user-centric design and robust security. This trend underscores the industry’s commitment to fostering transparency, minimizing delays, and ensuring secure data sharing.

Artificial intelligence (AI) is transforming the global construction software industry through predictive analytics, which uses historical project data and real-time inputs to forecast delays, resource needs, and risk scenarios. For example, a recent initiative introduced an AI module that analyzes equipment performance and maintenance history to schedule service proactively. This development reduces unplanned downtime and aligns maintenance with project timelines. Integrating AI in this manner boosts efficiency by flagging potential issues before they occur and suggesting corrective actions. It also enables teams to allocate resources more effectively and adjust plans based on evolving site conditions.

General contractors lead the global construction software market, especially in adopting construction software because they manage large-scale projects and coordinate multiple disciplines. They require comprehensive platforms that integrate scheduling, resource allocation, and collaboration features. Their preference for robust tools encourages vendors to support complex workflows and to prioritize reliability. General contractors’ high usage reinforces the development of modules tailored for project oversight and risk management. Their early adoption also signals value to other user groups and drives broader market acceptance. Their feedback often guides feature enhancements and integration with other enterprise systems.

Sub-contractors are growing at a rapid pace in the global construction software market, as they seek greater visibility into project requirements and schedules. They need tools that offer clear task assignments and real-time updates from general contractors, which is exactly what is offered by construction software. The digital nature of these tools allows for more efficient management of labor and materials. Also, the rapid adoption of mobile-friendly interfaces by them, prompts manufacturers to design lighter and more role-specific modules.

Large enterprises maintain the largest share in the global construction software market, mainly because they handle multiple concurrent projects and can allocate budget for integrated systems. They always favor platforms that offer scalability, advanced analytics, and integration with existing enterprise resource tools. Their procurement processes often seek vendors capable of customization and ongoing support. Large organizations also invest in training and change management to ensure proper adoption of such tools. Their long-term contracts and high-volume requirements drive vendors to enhance security, compliance, and reporting capabilities.

Small and medium enterprises are growing in the global construction software market as they are increasingly adopting construction software as solutions become more modular and cost-effective. They look for flexible licensing or subscription models that match their budgets. Their demand for user-friendly interfaces leads vendors to simplify onboarding and provide targeted training resources. Cloud-based offerings and mobile access appeal strongly to them because SMEs often lack extensive IT infrastructure to support on-premise offerings.

North America leads the global construction software market because of its extensive digital maturity in construction and strong demand for efficiency. Project complexity in this region often requires integrated software that connects planning, execution, and reporting. Firms prioritize tools that support compliance, safety management, and collaboration across dispersed teams. Their widespread cloud adoption and AI-driven safety solutions also help address tight schedules and manage large labor forces. Established vendors tailor products to stringent regulatory standards and varied project scales. The presence of leading technology providers and significant infrastructure investments further cements North America’s dominant position.

The United States dominates the North American construction software market with its demand for advanced software, which is driven by large-scale projects and stringent safety regulations. A notable recent development here is a major firm deploying AI-based site safety tools to monitor worker risks and predict incidents in real time. This initiative reflects growing interest in predictive analytics to reduce delays and enhance compliance. Cloud-based collaboration platforms are now standard, enabling remote access to models and schedules. Vendors also focus on