The Federal Reserve’s anticipated rate cuts in the second half of 2025 are reshaping the investment landscape, particularly for high-growth technology stocks. With two 25-basis-point cuts expected by year-end, the dovish pivot is fueling optimism for sectors reliant on low-cost capital and consumer spending—categories where Procore Technologies (PCOR) sits squarely. As the construction tech leader navigates a pullback in its stock price, investors must weigh macroeconomic tailwinds against its fundamentals to determine if this is a strategic entry point.

Macro-Driven Sector Rotation: Why Tech Stocks Are in Focus

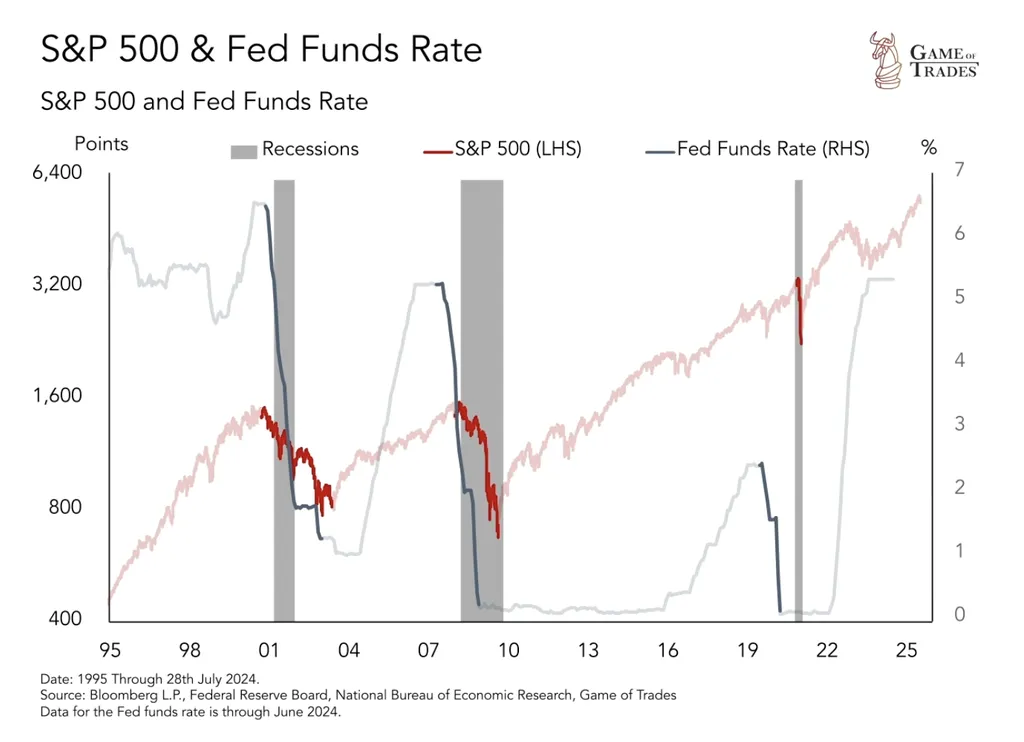

The Fed’s easing cycle is a textbook catalyst for growth-oriented equities. Lower interest rates reduce the discount rate in valuation models, making future cash flows from high-growth companies more attractive. For SaaS firms like PCOR, which operate in capital-intensive, innovation-driven sectors, this environment is particularly favorable. Historically, SaaS companies with strong gross margins and scalable business models outperform during rate-cutting cycles. PCOR’s 83% non-GAAP gross margin and 95% gross revenue retention rate (as of Q2 2025) position it well in this context. The company’s recent acquisitions of Novorender and Flypaper Technologies to bolster its BIM capabilities also align with the AI-driven productivity trends that are gaining traction in construction. The Fed’s focus on easing inflationary pressures—particularly from tariffs—adds another layer of support. While goods inflation remains sticky, services inflation is cooling, and the Fed’s data-dependent approach suggests further cuts are likely if labor market softening persists. This creates a “Goldilocks” scenario for tech stocks: accommodative monetary policy without the risk of aggressive tightening.

PCOR’s Fundamental Turnaround: Progress and Pitfalls

Procore’s Q2 2025 results highlight both its strengths and vulnerabilities. Revenue grew 14% year-over-year to $324 million, driven by 195 net new organic customers and a 15% increase in high-value ($100K+ ARR) clients. The company’s 95% gross retention rate underscores its defensiveness in a competitive market. However, profitability remains a concern. Non-GAAP operating margins fell to 13% from 18% in Q2 2024, reflecting increased R&D and sales investments. Free cash flow contracted sharply to $11 million in Q2, down from $46.6 million in Q1, as the company ramps up capital expenditures. While these investments are necessary to maintain its leadership in construction tech, they raise questions about near-term margin sustainability. The company’s valuation metrics are mixed. At a P/S ratio of 8.21x and EV/EBITDA of 41.1x, PCOR trades at a premium to the SaaS industry average (P/S: 8.12x, EV/EBITDA: 19.88x). This premium is justified by its strong gross margins and market position but appears stretched given its declining EBITDA margins and Rule of 40 score of 1% (a metric combining growth and profitability).

Valuation Attractiveness: A Pullback or a Trap?

PCOR’s recent 3.87% post-earnings decline, despite beating revenue and EPS estimates, offers a potential entry point for long-term investors. The stock’s pullback to $74.51 (from a 52-week high of $88.92) has brought its P/E ratio to 57.7x, down from a peak of 65x earlier in the year. This aligns it with the SaaS sector’s average P/E of 50x, suggesting the market is recalibrating expectations. The key question is whether PCOR’s valuation reflects its long-term potential. Its strategic moves—such as securing FedRAMP certification to enter the federal government market—signal ambition beyond its core construction vertical. If the company can scale these initiatives while stabilizing margins, its current valuation could prove attractive. However, risks persist. The Fed’s rate cuts are contingent on inflation staying within 2% targets, and any reversal of the dovish pivot could pressure growth stocks. Additionally, PCOR’s heavy R&D spending and capital expenditures must translate into tangible revenue growth to justify its multiples.

Investment Thesis: Strategic Entry Point with Caveats

For investors with a 3–5 year horizon, PCOR’s pullback offers a compelling case. The Fed’s easing cycle is a tailwind for SaaS valuations, and Procore’s leadership in construction tech—coupled with its AI-driven innovation—positions it to benefit from industry digitization. Its strong gross retention rate