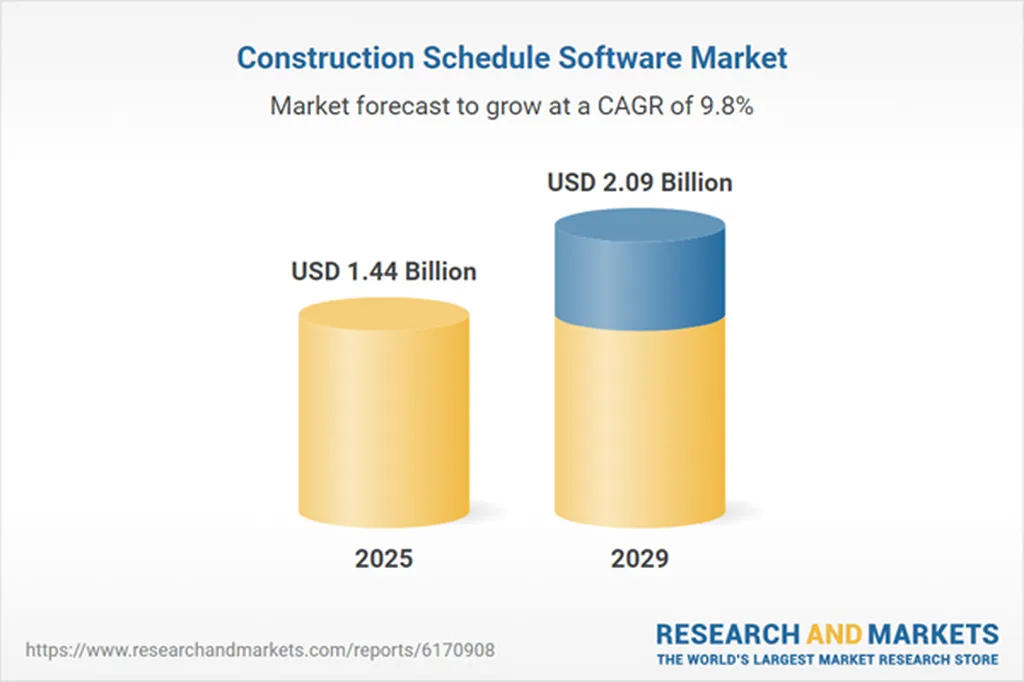

The construction schedule software market is undergoing a seismic shift, with the sector’s value surging from $1.31 billion in 2024 to an estimated $1.44 billion in 2025. This rapid expansion, fueled by a 10.1% compound annual growth rate (CAGR), is not merely a numerical trend but a testament to the industry’s evolving needs and technological advancements. As the market is projected to reach $2.09 billion by 2029, reflecting a 9.8% CAGR, it’s clear that construction scheduling software is becoming an indispensable tool in the modern builder’s arsenal.

At the heart of this growth lies the increasing demand for real-time collaboration and digital project management tools. The construction industry, long known for its fragmented and siloed workflows, is embracing technology to streamline processes, enhance communication, and mitigate risks. The rise of prefab and modular construction trends, coupled with the urgent need to tackle project delays and cost overruns, is driving this digital transformation. Mobile and cloud-based solutions are further accentuating this trend, enabling stakeholders to access critical project data anytime, anywhere.

The construction boom, particularly in infrastructure projects, is propelling the demand for innovative scheduling tools. Data from the UK Office for National Statistics highlights a $19.96 million increase in construction activities in 2022, underscoring the market’s potential to enable smooth project execution and resource allocation.

Major industry players are spearheading this technological innovation. ALICE Technologies Inc., for instance, has launched ALICE Plan, a 2D visual project planning tool that enhances collaboration through interactive scheduling interfaces. Meanwhile, Sage Group plc’s acquisition of Corecon Technologies Inc. aims to solidify its construction software portfolio, offering a suite of tools from project bidding to completion.

Leading companies like Microsoft Corporation, Oracle Corporation, Hilti Corporation, and Autodesk Inc. are expanding their market presence by integrating cutting-edge technology within construction schedules. These entities are not just selling software; they are offering solutions that improve efficiency, sustainability, and ultimately, the bottom line.

Geographically, North America stands as the largest market, with significant contributions also stemming from Asia-Pacific, Europe, and other regions. This widespread adoption reflects the growing acknowledgment of construction scheduling software’s benefits in optimizing project workflows and minimizing time lags.

However, the ongoing evolution of trade relations and tariffs poses challenges but also opportunities within the tech sector. As global dynamics shift, firms are leveraging AI and automation to mitigate operational risks and enhance resilience, ensuring continued progress even amid international uncertainties.

This comprehensive market report explores the largest and fastest-growing markets for construction schedule software, integrating this sector within the broader economic framework. It delves into technological advancements, regulatory transformations, and evolving consumer preferences as key market influencers.

The report encompasses essential market attributes, including market size, growth, segmentation, regional and national breakdowns, competitive landscapes, market shares, and strategic recommendations for market participants. It presents historical and predictive market growth insights by geographical region, offering a holistic view of the market’s trajectory.

Highlighted sections of the report include an in-depth examination of market dynamics, forward-looking growth projections, and analyses of influencing factors such as AI, automation, geopolitical incidents, and economic variables. It also provides a depiction of market competitiveness, spotlighting principal competitors and key financial transactions.

Trends and strategies suggesting pathways to recovery and development post-crisis are also explored. The report covers various software types and leading companies such as Microsoft, Oracle, Autodesk, and Trimble, among others. It offers in-depth analysis across Western and Eastern Europe, Asia-Pacific, North and South America, the Middle East, and Africa.

As the construction industry continues to evolve, the role of scheduling software will become increasingly pivotal. It’s not just about keeping projects on track; it’s about redefining how we build. The companies that embrace this digital transformation will be the ones that shape the future of construction.