The global hyperscale data center market is on the cusp of a transformative decade, with projections indicating a robust compound annual growth rate (CAGR) of 9.58% from 2024 to 2030. This surge is not merely a reflection of increased IT infrastructure investment—it signifies a fundamental shift in how businesses and governments approach digital infrastructure, driven by the insatiable demand for cloud services, AI, and big data analytics.

At the heart of this growth is the relentless pursuit of efficiency and sustainability. The adoption of liquid cooling technologies, for instance, is expected to skyrocket by an absolute growth rate of 142% between 2025 and 2030. This shift is not just about keeping servers cool; it’s about reimagining the very architecture of data centers to meet the escalating demands of high-performance computing (HPC) while minimizing environmental impact. Hyperscale operators like AWS, Google, Meta, and Microsoft are at the forefront of this evolution, investing heavily in Open Compute Project (OCP)-scale infrastructure to support data center racks with power densities up to 1MW.

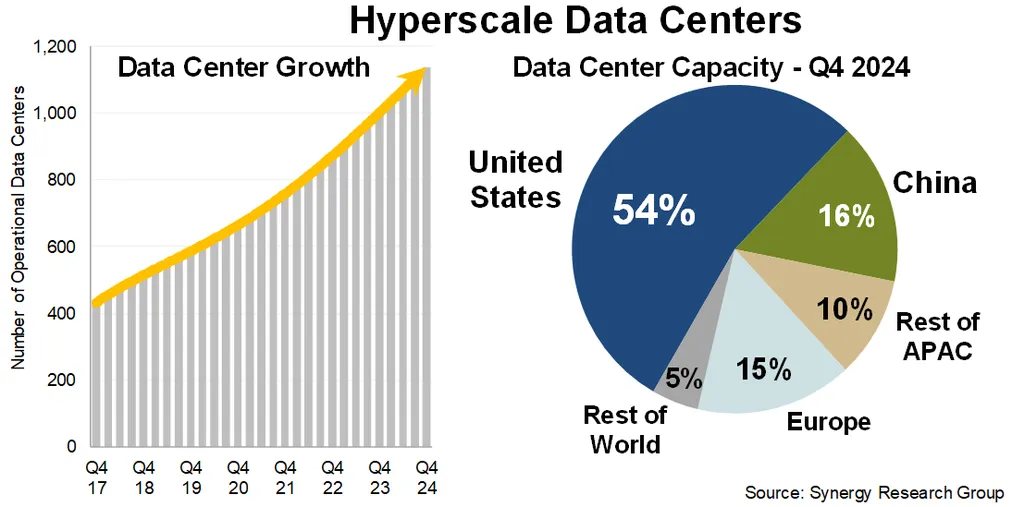

Geographically, the market is a tale of two powerhouses: the US and China, which together account for around 70% of hyperscale data center investments in 2024. However, the story doesn’t end there. Regions like APAC, Europe, Latin America, and the Middle East & Africa (MEA) are witnessing exponential growth, fueled by a confluence of factors including government initiatives, favorable regulations, and the burgeoning demand for digitalization and AI. In Europe, stringent data privacy laws and robust infrastructure connectivity are driving investment, while the MEA region offers ample land and abundant renewable energy resources, positioning it as one of the fastest-growing markets globally.

The vendor landscape is equally dynamic, with IT infrastructure providers like Cisco Systems, Dell Technologies, and Huawei Technologies competing to provide advanced solutions. Meanwhile, support infrastructure players such as ABB, Eaton, and Honeywell are innovating to meet the unique challenges of hyperscale data centers. The construction sector is also benefiting from this boom, with global contractors and subcontractors like Bouygues Construction and Turner & Townsend reaping millions in revenues from new data center projects.

Yet, this growth is not without its challenges. Power constraints in North America, land and regulatory hurdles in APAC, and high operational costs in Europe are just a few of the obstacles that the industry must navigate. Moreover, the rapid pace of technological advancement demands constant adaptation, as data centers strive to keep up with the evolving needs of AI, IoT, and quantum computing.

As the global hyperscale data center market hurtles towards 2030, one thing is clear: the future of digital infrastructure is being built today. The choices made by operators, vendors, and governments over the next decade will shape not just the market, but the very fabric of our digital world. The question is, will they rise to the challenge?