The commercial real estate (CRE) industry is stepping into 2026 with a mix of optimism and caution, as economic recovery and technological advancements collide with persistent structural challenges. The Global Real Estate Outlook 2026 report by JLL paints a picture of an industry on the brink of transformation, driven by six key forces that will reshape markets in the coming year.

Economic tailwinds are providing a solid foundation for growth. Economic growth across major markets, easing trade concerns, moderating inflation, and lower interest rates are all contributing to a positive outlook. Capital market conditions have strengthened significantly, with debt markets expected to remain active and investor bidding competitiveness on the rise. This momentum is anticipated to support higher transaction volumes, particularly in sectors like data centres, which are benefiting from the AI infrastructure boom, and the Living sector, which remains the largest global investment category.

Leasing activity is also projected to increase across most geographies and sectors. In the US, India, and the UK, office and industrial take-up is set to grow, while lower levels of new construction will exacerbate supply constraints. In global hubs like Tokyo, New York, and London, shortages of quality office space are expected to push occupancy costs higher and broaden demand beyond the top tier of the market. Industrial and logistics deliveries are forecast to fall sharply, contributing to tightening vacancies.

However, the convergence of economic, technological, and social dynamics is placing the CRE industry on the precipice of substantial—and exciting—transformation. The report outlines six forces driving this structural change.

First, the efficiency imperative in a higher-cost environment is pushing organisations to scrutinise budgets, optimise space use, and improve operational efficiencies. With 72% of corporate real estate leaders identifying costs and budget efficiency as their top priority, cost management strategies are expected to fuel increased outsourcing, supply-chain optimisation, and technology adoption in building operations.

Second, intensifying supply shortages are widening across major regions due to economic uncertainty and high finance and construction costs. US office completions are set to drop 75% in 2026, while European starts are at their lowest levels since 2010. Shortages are also becoming more acute in the industrial, retail, and housing sectors. Meanwhile, extensive retrofitting demand is emerging, with more than 130 million square metres of global office stock at risk of obsolescence. Energy-focused upgrades can generate a “55% higher return when done earlier in a building’s life cycle,” according to the report.

Third, the experience economy is gaining traction, with more than two-thirds of people globally seeking high-quality, personalised, and wellness-oriented environments. The report warns of “experience obsolescence” for assets that fail to keep pace. Employees are showing more willingness to comply with attendance policies when the workplace “feels worth the commute,” and 73% say more greenery would improve wellbeing.

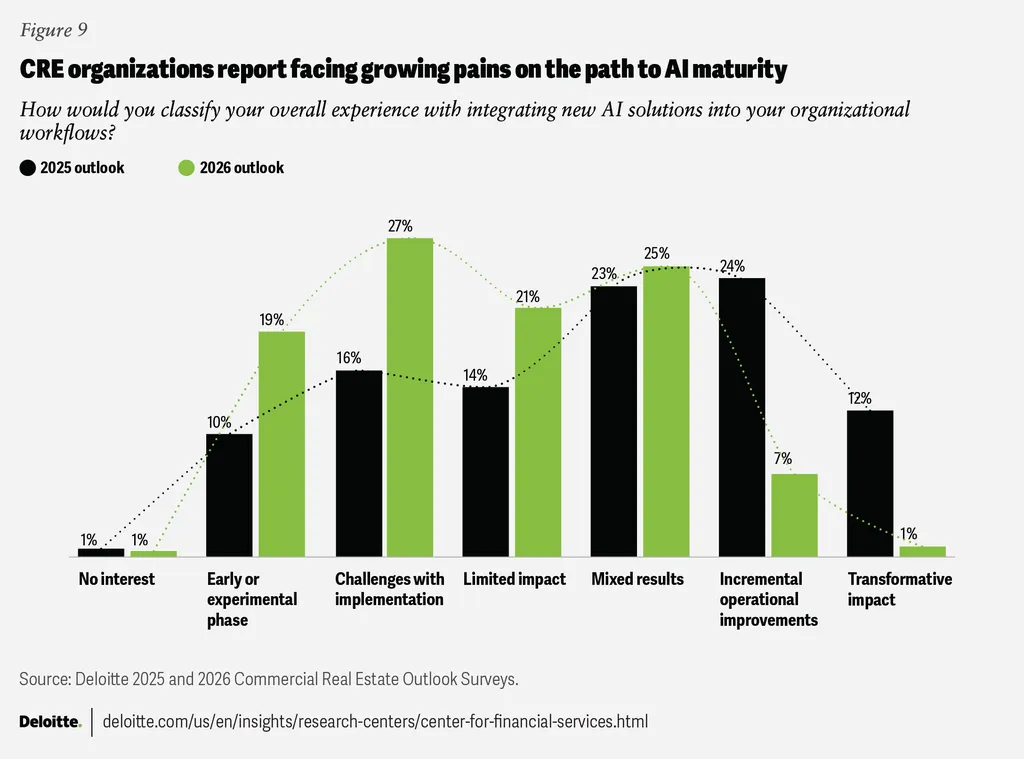

Fourth, AI is reaching a critical juncture. AI adoption surged in 2025, with 92% of corporate occupiers and 88% of investors launching pilots. However, only 5% achieved most programme goals. In 2026, many organisations are expected to encounter “AI pilot fatigue” as fragmented approaches and limited data, talent, and change-management capacity hinder scaling. As many as 60% of investors still lack a unified technology strategy.

Fifth, the convergence of buildings and power systems is becoming a defining factor for asset competitiveness. Power demand from data centres rose 21% in 2025 and is forecast to more than double by 2030. Buildings are operating as part of local energy systems through on-site generation and storage. Assets able to integrate such solutions can capture “revenue uplift of 25% to 50% compared to rent.”

Finally, the democratisation of CRE investment is opening access to broader investor groups. Regulatory shifts, including the UK’s Mansion House Accord and new US rules permitting 401(k) plans to offer private real estate funds, are expanding participation. Rising private wealth and growing use of blockchain-based fractional ownership platforms are further fueling this trend.

As the CRE industry navigates these forces, it is clear that the future will be shaped by those who can adapt and innovate. The industry is not just building structures; it is constructing the foundation for a more efficient, sustainable, and inclusive urban future. The challenge—and the opportunity—lies in balancing economic imperatives with the urgent need to mitigate climate change and create resilient, people-centric spaces. The road ahead is complex, but the potential for transformation is immense.