In early December 2025, Trimble Inc. made a strategic move that sent ripples through the construction technology sector. The company announced a new share repurchase program, authorizing up to US$1.00 billion in common stock with no expiration date, effectively replacing its prior US$1.00 billion authorization. This financial maneuver, while routine in corporate strategy, underscores a broader narrative about Trimble’s evolution and the shifting dynamics within the construction technology landscape.

Trimble’s decision to repurchase shares is not merely a financial tactic; it’s a signal of confidence in the company’s trajectory. The move comes at a pivotal moment as Trimble transitions from hardware-centric sales to higher-margin, software, and subscription-based workflows. This shift is critical for Trimble, as it aims to pivot towards recurring revenue models that promise greater stability and profitability.

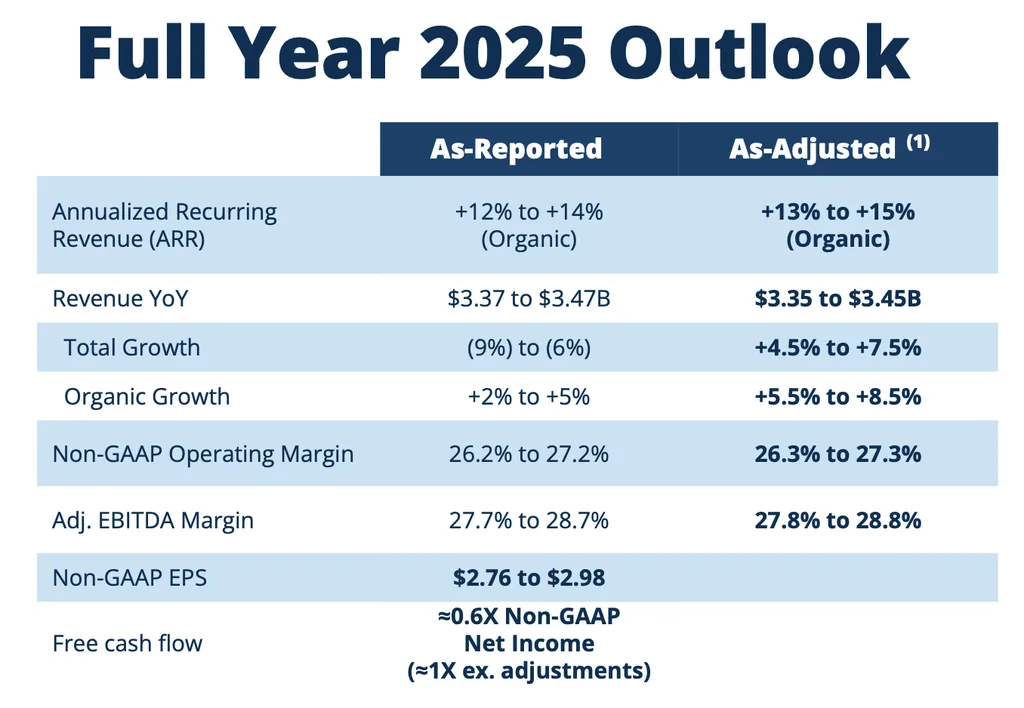

The new buyback program, however, does not alter the core thesis of Trimble’s investment narrative in the short term. Instead, it complements a key near-term catalyst: recurring revenue growth. Trimble’s strategy is to leverage its technology to offer continuous value to its customers, thereby securing a steady stream of income. This approach is particularly relevant in the construction and infrastructure sectors, where precision and efficiency are paramount.

Trimble’s expansion of its Trimble Technology Outlet network further illustrates this strategy. By adding Southeastern Equipment Company as an authorized reseller across five U.S. states, Trimble is widening the reach of its construction technology solutions. This expansion is not just about increasing sales; it’s about embedding Trimble’s technology deeper into the daily operations of construction firms. The company’s grade control, site positioning, and correction services are now more accessible to a broader audience, potentially driving higher adoption rates for connected hardware and subscription services.

Yet, this expansion also brings with it a set of challenges. As Trimble’s technology becomes more ubiquitous, the pressure to maintain differentiation intensifies. Competitors are not standing still; they are accelerating their own advancements in AI and cloud-based solutions. Trimble must ensure that its offerings remain superior, not just in functionality but also in value proposition, to justify the premium pricing that often accompanies higher-margin services.

The broader implications of Trimble’s share repurchase and network expansion are significant for the construction industry. As companies like Trimble invest heavily in technology and innovation, they are reshaping the sector’s landscape. The shift towards software and subscription-based models is not just a financial strategy; it’s a response to the evolving needs of construction firms. These firms are increasingly seeking integrated, data-driven solutions that enhance efficiency, reduce costs, and improve project outcomes.

Moreover, the emphasis on recurring revenue models aligns with a broader trend in the technology sector. Companies are moving away from one-off sales to ongoing service models, which provide more predictable revenue streams and deeper customer relationships. This shift is particularly relevant in the construction industry, where long-term projects and complex workflows benefit from continuous support and updates.

Trimble’s narrative projects substantial growth, aiming for $4.1 billion in revenue and $776.4 million in earnings by 2028. This ambitious target requires a 4.3% yearly revenue growth and a significant increase in earnings. Achieving these goals will depend on Trimble’s ability to execute its strategy effectively, navigate competitive pressures, and capitalize on emerging opportunities.

For investors, the question is whether Trimble can sustain its momentum in the face of intensifying competition. The company’s fair value estimates, ranging from US$98.45 to US$102.42 per share, suggest a potential upside of up to 23% from its current price. However, these estimates are based on current market conditions and may not account for the rapid pace of technological change.

As Trimble continues to evolve, its success will hinge on its ability to innovate and adapt. The company’s focus on recurring revenue and technological differentiation is a step in the right direction, but it must remain vigilant in the face of competitive threats. The construction industry is on the cusp of a technological revolution, and Trimble’s role in shaping this future will be crucial.