The buildings construction market is entering a pivotal phase, with projections indicating a surge from US$ 6,732.34 billion in 2024 to US$ 10,453.02 billion by 2033, growing at a CAGR of 5.01% between 2025 and 2033. This expansion is not merely a numerical trend but a reflection of profound shifts in how we design, build, and inhabit our urban environments. Rapid urbanization, technological advancements, and sustainability mandates are reshaping the sector, presenting both opportunities and challenges for industry stakeholders.

At the heart of this transformation is the global push towards urbanization. As populations concentrate in cities, the demand for modern housing, commercial facilities, and industrial infrastructure is surging. Governments and private investors are allocating substantial capital to urban development, transportation hubs, and mixed-use complexes that integrate residential, commercial, and recreational spaces. “Urbanization remains the most powerful growth catalyst for the Buildings Construction Market,” according to Renub Research. This trend is particularly evident in emerging economies in Asia-Pacific, Latin America, and parts of Africa, where unprecedented urban expansion is driving demand for new construction projects.

Technological advancements are fundamentally altering construction processes. Tools such as Building Information Modeling (BIM), drones, robotics, and automation are redefining project accuracy, cost efficiency, and safety. “Technology is fundamentally transforming construction processes,” notes Renub Research. BIM platforms allow stakeholders to visualize projects in three dimensions, identify conflicts before construction begins, and optimize resource allocation. Drones and robotics enhance site monitoring and safety, while 3D printing is being explored for rapid prototyping and component manufacturing. These innovations are not just improving efficiency; they are also enabling the construction of smarter, more sustainable buildings.

Sustainability has become a defining feature of the industry. Developers are increasingly prioritizing green materials, energy-efficient systems, and circular construction techniques to comply with environmental regulations and meet the expectations of eco-conscious investors and occupants. “Environmental responsibility has become central to modern construction,” states Renub Research. Green buildings integrate renewable energy systems, high-performance insulation, water conservation technologies, and recyclable materials. These features reduce long-term operating costs, enhance occupant comfort, and align with global climate goals. Incentives, tax benefits, and certification programs such as LEED and BREEAM further accelerate the adoption of sustainable construction practices, making sustainability both an ethical and economic driver of market expansion.

However, the industry is not without its challenges. Volatile raw material prices and supply chain disruptions are impacting budgets and timelines. “Construction projects are highly sensitive to the prices of key materials such as steel, cement, timber, and aluminum,” warns Renub Research. Contractors face difficulties in maintaining profitability when material costs fluctuate unpredictably. Delays in procurement can stall large-scale projects, especially those dependent on imported resources. While firms are adopting strategies such as long-term supplier contracts, digital procurement systems, and localized sourcing, maintaining cost stability remains a persistent challenge across the industry.

Labor shortages and skill gaps are also significant hurdles. The construction sector is experiencing a growing shortage of skilled workers due to an aging workforce and declining interest in traditional trades. “The construction sector is experiencing a growing shortage of skilled workers due to an aging workforce and declining interest in traditional trades,” according to Renub Research. At the same time, the adoption of advanced technologies requires specialized skills in digital modeling, automation, and project analytics. Labor shortages often result in project delays, higher wages, and increased safety risks. To address this, companies are investing in training programs, apprenticeships, and collaborations with technical institutions. Automation and prefabrication are also being used to reduce dependence on manual labor. However, closing the skills gap remains critical for sustaining productivity and quality in the long term.

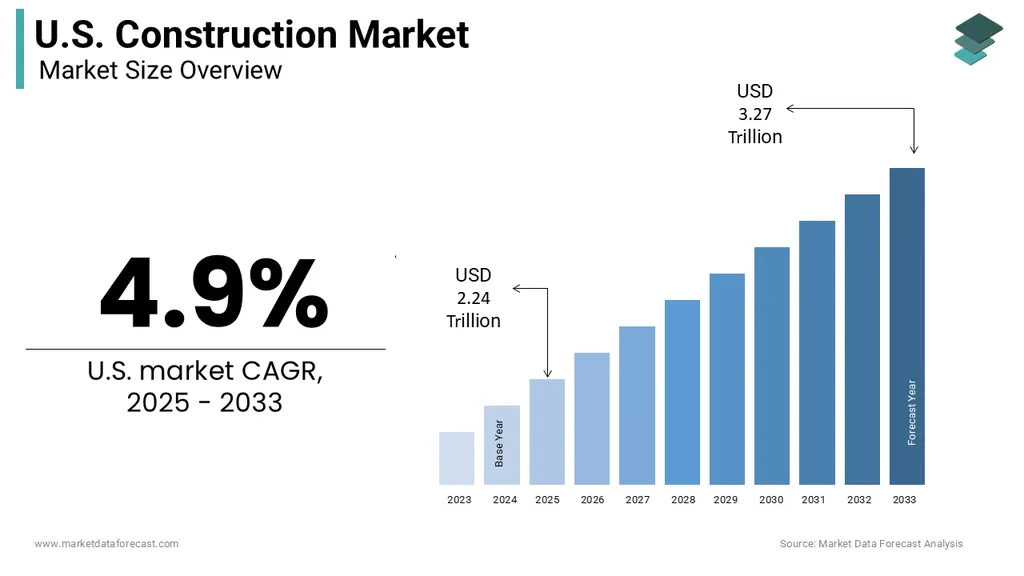

Regionally, the market demonstrates strong diversity, shaped by economic conditions, regulatory frameworks, and development priorities. In the United States, robust housing demand, large-scale infrastructure spending, and rapid adoption of construction technologies are driving growth. Residential construction continues to expand in response to urban growth and demographic shifts, while commercial and industrial projects gain momentum through economic recovery and logistics sector expansion. Federal and state-level infrastructure programs are modernizing transportation systems, public facilities, and green buildings. BIM, modular construction, and automation are increasingly used to enhance efficiency and reduce costs.

In the United Kingdom, sustainability-led policies, urban regeneration, and advanced building technologies are shaping the market. Government initiatives promoting carbon-neutral infrastructure and green building standards influence project design and execution. Housing development remains a priority, supported by affordability programs and population growth. Commercial construction benefits from investments in logistics centers, smart offices, and mixed-use developments. While regulatory changes and workforce constraints present challenges, the UK market remains resilient through public–private